ATTENTION: Homebuyers

FHA Loans in 2025: Requirements, Limits, and How to Qualify with Bad Credit

Looking to buy a home or refinance? Learn everything about FHA loans in 2025, including updated requirements, loan limits, how to qualify, and why they’re great for buyers with bad credit. Find out whether an FHA loan is right for you!

FHA Loan Requirements in 2025

Understanding the requirements for an FHA loan is crucial whether you're a first-time homebuyer or refinancing an existing mortgage. Since FHA loans are insured by the Federal Housing Administration, lenders tend to offer more flexible qualification criteria compared to conventional loans. However, borrowers must still meet specific requirements to qualify. Here's a breakdown of the key FHA loan requirements in 2025:

1. Minimum Credit Score Requirement

FHA loans are well-known for being accessible to borrowers with lower credit scores. Here’s how credit score requirements break down:

580 or higher Eligible for the minimum down payment of 3.5%.

500 to 579 Requires a 10% down payment.

Below 500 Generally not eligible for an FHA loan unless there are extenuating circumstances.

2. Down Payment Requirement

One of the biggest advantages of an FHA loan is the low down payment requirement.

Borrowers with a credit score of 580 or higher can put down as little as 3.5%.

Borrowers with a credit score between 500 and 579 must put down 10%.

FHA loans allow buyers to use gift funds from family or down payment assistance programs, making it easier for first-time buyers to afford a home.If your credit score is below 580, taking steps to improve it can increase your chances of qualifying for an FHA loan. Check out our guide on How to Improve Your Credit Score for an FHA Loan for actionable tips.

3. Debt-to-Income (DTI) Ratio Limits

The debt-to-income ratio (DTI) compares your total monthly debt payments to your gross monthly income. Lenders use this ratio to determine if you can handle the financial responsibility of a mortgage.

Generally, the FHA recommends a maximum DTI ratio of 43%, but some lenders may approve borrowers with a DTI as high as 50%, especially if other factors, such as credit score and down payment, are strong.

4. Property Requirements

FHA loans are designed to help buyers purchase a primary residence. As such, the property must meet certain standards:

Primary Residence Only: The home must be the borrower’s primary residence. FHA loans cannot be used for vacation homes or investment properties.

Property Condition: The home must meet minimum property standards as determined by an FHA appraisal. This ensures the home is safe, livable, and structurally sound.

If the property doesn’t meet these standards, the seller may need to make repairs before the loan can be approved.

5. Employment and Income Verification

FHA lenders require proof of steady employment and income. Typically, you’ll need:

Two years of consistent employment history

Recent pay stubs,

W-2s, and tax returns to verify your income.

Self-employed borrowers may need to provide additional documentation, such as profit and loss statements.

FHA Loan Limits for 2025

FHA loan limits refer to the maximum loan amount a borrower can receive through an FHA-insured mortgage. These limits are determined annually by the Federal Housing Administration based on local housing market conditions. FHA loan limits can vary significantly depending on the county, with higher-cost areas having larger limits to accommodate pricier homes.

1. How Are FHA Loan Limits Determined?

FHA loan limits are based on the

conforming loan limits

set by the Federal Housing Finance Agency (FHFA). For 2025, the limits are expected to rise due to increasing home prices across the country.

Low-cost areas: The minimum limit (also known as the “floor”) is set at 65% of the conforming loan limit.

High-cost areas: The maximum limit (also known as the “ceiling”) is set at 150% of the conforming loan limit.

These limits ensure that buyers in expensive real estate markets can still access FHA financing.

2. Examples of FHA Loan Limits by Location

Here are some examples of projected FHA loan limits for 2025:

Low-cost areas: A city like Omaha, Nebraska, may have a loan limit around $472,030 for a single-family home.

High-cost areas: In high-cost markets like San Francisco, California, the loan limit may reach $1,089,300for a single-family home.

3. Why Loan Limits Matter for Buyers

Loan limits are critical because they determine how much a buyer can borrow while still benefiting from the flexible FHA loan requirements.

If you’re buying a home in a high-cost area, an increased loan limit means you may not need to seek a jumbo loan, which typically has stricter requirements and higher interest rates.

Staying within FHA loan limits allows you to take advantage of lower down payments and more lenient credit score requirements.

How to Qualify for an FHA Loan

Qualifying for an FHA loan can be easier than qualifying for a conventional loan due to more lenient credit, down payment, and income requirements. Whether you’re a first-time homebuyer or a homeowner looking to refinance, here are the key steps to help you qualify for an FHA loan:

1. Check Your Credit Score

FHA loans are designed for borrowers with less-than-perfect credit.

A credit score of 580 or higher qualifies you for the minimum down payment of 3.5%.

If your credit score is between 500 and 579, you can still qualify, but you’ll need a 10% down payment.

Scores below 500 typically won’t qualify unless there are exceptional circumstances.

2. Save for a Down Payment

One of the biggest advantages of FHA loans is the low down payment requirement.

Most borrowers need to save 3.5% of the home’s purchase price as a down payment.

Unlike conventional loans, FHA allows borrowers to use gift funds from family members or assistance programs to cover the down payment.

Example: On a $300,000 home, a 3.5% down payment would be $10,500.

3. Reduce Your Debt-to-Income Ratio (DTI)

Your DTI ratio is a key factor lenders consider when determining your ability to repay a mortgage.

Most FHA lenders prefer a DTI ratio of 43% or lower, although some may accept ratios as high as 50% with compensating factors such as a higher down payment or excellent employment history.

To calculate your DTI, divide your total monthly debt payments by your gross monthly income.

Tip: Paying down high-interest debts before applying can improve your DTI and boost your chances of approval.

4. Gather Necessary Documentation

To speed up the loan approval process, have all the necessary documentation ready:

Proof of Income: Recent pay stubs, W-2s, or tax returns for self-employed individuals.

Employment History: Lenders typically require a two-year employment history.

Assets and Savings: Bank statements to verify funds for the down payment and closing costs.

Identification: A government-issued ID and Social Security number.

5. Get Pre-Approved by an FHA Loan Lender

Before you start house hunting, it’s wise to get pre-approved by an FHA loan lender. Pre-approval gives you a clear idea of how much you can borrow and shows sellers you’re a serious buyer. CLICK HERE TO CHECK ELIGIBILITY.

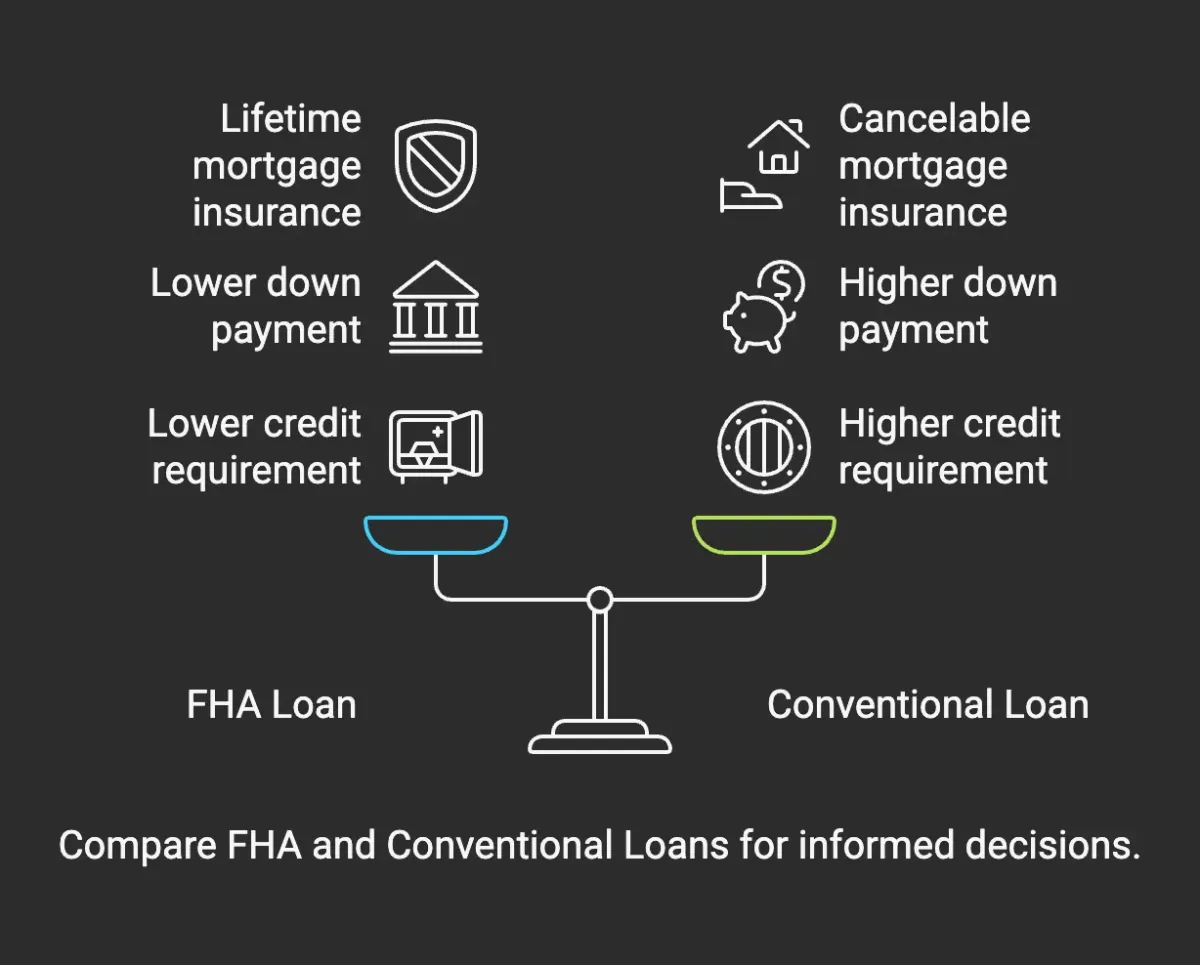

FHA vs. Conventional Loans: Which Is Better?

Choosing between an FHA loan and a conventional loan is one of the biggest decisions homebuyers and refinancers face. While both types of loans can help you purchase or refinance a home, they differ significantly in terms of requirements, costs, and overall flexibility. Here’s a detailed comparison to help you determine which loan might be best for your situation:

1. Key Differences Between FHA and Conventional Loans

2. Pros and Cons of FHA Loans

Pros: Lower credit score requirements make FHA loans ideal for borrowers with bad credit.

The low down payment requirement of 3.5% makes homeownership more accessible, especially for first-time buyers.FHA loans are assumable, meaning future buyers can take over your loan with its lower interest rate, a valuable feature in a high-rate environment.

Cons: Mortgage insurance premiums (MIP) are mandatory and remain for the life of the loan unless you refinance to a conventional loan. FHA loans have stricter property requirements, meaning the home must meet certain safety and livability standards. You can only use an FHA loan for a primary residence, unlike conventional loans, which can be used for second homes or investment properties.

3. Pros and Cons of Conventional Loans

Pros:

No ongoing mortgage insurance once you have 20% equity in the home.

More flexibility in terms of property types (primary residence, second home, or investment property). Typically, you can avoid paying an upfront mortgage insurance premium (UFMIP), which FHA loans require.

Cons:

Stricter credit requirements: You’ll typically need a credit score of at least 620 to qualify for a conventional loan.

Higher down payment requirements for borrowers with lower credit scores. Without a large down payment, private mortgage insurance (PMI) can significantly increase monthly costs until enough equity is built.

4. When FHA Loans Are Better

First-time homebuyers: FHA loans are popular among first-time buyers because of the lower down payment and lenient credit requirements.

Buyers with bad credit: If your credit score is less than 620, you’re more likely to qualify for an FHA loan.

Those with limited savings: FHA loans allow down payments as low as 3.5%, and you can use gift funds to cover the down payment.

FHA loans are an excellent choice for first-time homebuyers due to their low down payment and flexible credit requirements. Learn more with our Top Tips for First-Time Homebuyers.

5. When Conventional Loans Are Better

Buyers with strong credit: If your credit score is 620 or higher, you may qualify for better rates and lower overall costs with a conventional loan.

Borrowers with 20% down payment: If you can afford a 20% down payment, a conventional loan allows you to avoid paying mortgage insurance entirely.

Second home or investment property buyers: Since FHA loans are limited to primary residences, conventional loans are the better option for buying vacation homes or rental properties.

6. Which Loan Is Right for You?

The choice between an FHA loan and a conventional loan ultimately depends on your financial situation, credit score, and long-term goals.

If you have a lower credit score or limited savings, an FHA loan is likely your best option.

If you have a higher credit score and can afford a larger down payment, a conventional loan may save you money in the long run by eliminating the need for lifelong mortgage insurance.

Tip: It’s a good idea to work with both an FHA loan lender and a mortgage broker to compare offers and find the loan that best meets your needs. CLICK HERE TO CHECK ELIGIBILITY.

FHA Mortgage Insurance: How It Works and When It Ends

This is 1.75% of the loan amount, typically paid at closing.

Borrowers have the option to pay it upfront in cash or roll it into the loan balance.

Example: On a $300,000 loan, the upfront premium would be $5,250

.

One of the key factors that sets FHA loans apart from conventional loans is the requirement for mortgage insurance premiums (MIP). While this insurance makes it easier for borrowers with lower credit scores to qualify for a loan, it does add to the overall cost of the mortgage. Understanding how FHA mortgage insurance works—and how to eliminate it—can help you make an informed decision about whether an FHA loan is right for you.

1. What Is FHA Mortgage Insurance?

FHA mortgage insurance protects the lender in case the borrower defaults on the loan. Since FHA loans have lower down payment and credit score requirements, this insurance helps reduce the risk for lenders.

There are two types of mortgage insurance premiums (MIP) for FHA loans:

Upfront Mortgage Insurance Premium (UFMIP):

This is 1.75% of the loan amount, typically paid at closing.

Borrowers have the option to pay it upfront in cash or roll it into the loan balance.

Example: On a $300,000 loan, the upfront premium would be $5,250.

Annual Mortgage Insurance Premium (MIP):

This is paid annually but broken into monthly payments as part of your mortgage. The percentage varies based on the loan amount, term, and loan-to-value (LTV) ratio. Typically ranges between 0.45% and 1.05% of the loan balance annually.

Example: On a $300,000 loan with a 0.85% MIP rate, you’d pay about $212.50 per month for mortgage insurance.

2. How Long Do You Have to Pay FHA Mortgage Insurance?

The duration of FHA mortgage insurance depends on your down payment and loan term:

If your down payment is less than 10%: You’ll be required to pay annual MIP for the entire life of the loan.

If your down payment is 10% or more: You’ll be required to pay annual MIP for 11 years.

This differs from conventional loans, where private mortgage insurance (PMI) can be canceled once you’ve built 20% equity in your home.

3. How to Remove FHA Mortgage Insurance: The only way to eliminate FHA mortgage insurance entirely is by

refinancing into a conventional loan.

Here’s how it works:

Refinance once you reach 20% equity: Once your home value has increased, or you’ve paid down your loan balance enough to reach 20% equity, you can refinance into a conventional loan to avoid paying further mortgage insurance.

Benefits of refinancing: Eliminates the need for monthly MIP. Potentially lowers your interest rate if rates have dropped since you first obtained your FHA loan.

Tip: Before refinancing, compare current FHA and conventional loan rates with a mortgage broker to ensure it’s the right financial move. CLICK HERE TO CHECK ELIGIBILITY.

4. Pros and Cons of FHA Mortgage Insurance

Pros: Allows buyers with lower credit scores to qualify for a mortgage.Enables lower down payments, making homeownership more accessible.

Cons: Increases the overall cost of the loan. Mortgage insurance remains for the life of the loan unless refinanced. Upfront premium adds to your loan balance if not paid at closing.

5. Summary: Should You Be Concerned About FHA Mortgage Insurance?

While FHA mortgage insurance can add to the cost of your loan, it’s often worth it for borrowers who need a low down payment or have lower credit scores. FHA loans provide an accessible path to homeownership, especially for first-time buyers.

If your goal is to minimize long-term costs, refinancing to a conventional loan once you’ve built sufficient equity is a smart strategy.

Current FHA Loan Rates in 2025

FHA loan rates are an important factor for homebuyers and refinancers to consider, as they directly affect the affordability of your mortgage. Understanding how FHA loan rates work and how they compare to conventional loan rates can help you make an informed decision when choosing the best loan for your needs.

1. How Are FHA Loan Rates Determined?

FHA loan rates are influenced by several factors, including:

Market Conditions: Interest rates fluctuate based on broader economic factors such as inflation, unemployment, and the Federal Reserve’s monetary policy.

Borrower’s Credit Score: Although FHA loans are known for their lenient credit requirements, borrowers with higher credit scores typically qualify for better rates.

Loan Amount and Term: Rates may vary depending on whether the loan term is 15 years or 30 years, with shorter-term loans generally offering lower interest rates.

Lender Policies: Different lenders may offer slightly different FHA loan rates, so it’s important to shop around.

2. Current FHA Loan Rates vs. Conventional Loan Rates

In general, FHA loan rates tend to be slightly lower than conventional loan rates. This is because FHA loans are government-backed, reducing the lender’s risk. However, FHA loans come with mortgage insurance premiums (MIP), which can increase the overall cost of the loan. Loan TypeTypical Interest Rate (2025) Mortgage Insurance FHA Loan Slightly lowerUpfront and annual MIP required Conventional Loan Slightly higher PMI required if down payment < 20%

Example: Suppose you’re comparing an FHA loan at 6.25% with a conventional loan at 6.5%. While the FHA loan might have a lower rate, the added cost of MIP could result in a higher total monthly payment than a conventional loan with PMI that can eventually be canceled.

3. How to Find the Best FHA Loan Rates

To find the best FHA loan rates, consider the following steps:

Compare Multiple Lenders: Different lenders may offer varying rates and terms. Reach out to multiple FHA loan lenders and mortgage brokers to get quotes. BD Mortgage Group has been known to have the lowest rates in this region. CLICK HERE TO GET A FREE QUOTE.

Improve Your Credit Score: A higher credit score can help you qualify for lower rates, even with an FHA loan.

Lock in Your Rate: Once you’ve found a competitive rate, ask your lender about locking it in. This ensures you’ll get that rate even if market rates increase before closing.

4. Tips for Lowering Your FHA Loan Rate

Consider a Shorter Loan Term: FHA loans are available with terms as short as 15 years, which often come with lower interest rates compared to 30-year terms.

Make a Larger Down Payment: While FHA loans require as little as 3.5% down, putting down more may improve your rate and reduce your overall loan balance. Negotiate Closing Costs:Some lenders may allow you to pay discount points upfront to lower your interest rate.

5. Should You Refinance If Rates Drop?

If FHA loan rates drop significantly after you’ve taken out your mortgage, you may want to consider refinancing.

FHA Streamline Refinance: This is a quick and easy option for existing FHA borrowers that requires minimal documentation and no appraisal.

Refinance to a Conventional Loan: If you’ve built at least 20% equity in your home, refinancing to a conventional loan can help you eliminate MIP and take advantage of lower rates.

Tip: Before refinancing, consult a mortgage broker to compare the costs and benefits of different refinancing options.

Will FHA Loan Limits Increase in 2025?

FHA loan limits are reviewed and adjusted annually by the Federal Housing Administration (FHA) to reflect changes in the housing market. These limits determine the maximum amount a borrower can receive through an FHA-insured mortgage. For 2025, FHA loan limits are expected to rise, given the ongoing increase in home prices across the United States.

1. What Are FHA Loan Limits?

FHA loan limits set the upper boundary for how much you can borrow when using an FHA loan. These limits vary by:

County: Higher limits are set for counties with higher average home prices. Property Type: Loan limits differ depending on whether the property is a single-family home, duplex, triplex, or fourplex. FHA loan limits are tied to the conforming loan limits set by the Federal Housing Finance Agency (FHFA).

2. Current FHA Loan Limits (2024 as a Reference)

For 2024, the FHA loan limit for a single-family home in most low-cost areas was $472,030, while in high-cost areas, it went up to $1,089,300.

Example: In a low-cost county like Harris County, Texas, the limit was around $472,030. In a high-cost area like Los Angeles County, California, the limit reached $1,089,300.

3. Will FHA Loan Limits Increase in 2025?

With rising home prices in many parts of the U.S., it’s likely that FHA loan limits will increase for 2025. The FHA adjusts limits based on:

Median home prices in each county: Higher median prices result in higher loan limits. National housing market trends: An overall increase in home prices usually prompts the FHA to raise limits to ensure affordability for buyers. According to recent market data, many experts predict that FHA loan limits will rise by 5% to 7% in most areas, especially in regions with fast-growing home values.

4. How Rising Loan Limits Benefit Buyers

Higher FHA loan limits can be a significant advantage for buyers in competitive markets:

Increased affordability: With higher limits, borrowers can purchase more expensive homes without needing a jumbo loan, which typically has stricter requirements.

Lower down payment options: FHA loans allow you to put down as little as 3.5%, even on higher-priced homes (as long as the loan remains within the new limits).

Easier qualification: FHA loans have more lenient credit and DTI requirements compared to jumbo loans or high-balance conventional loans.

5. How to Stay Updated on FHA Loan Limits

To ensure you have the most accurate information, you can:

Visit the FHA’s official website: They publish annual loan limits by county. Consult with an FHA-approved lender: Lenders receive updated loan limit information as soon as it’s released.

Work with a mortgage broker: Brokers can help you compare FHA and conventional loan options based on current limits. CLICK HERE TO SPEAK WITH A LOAN OFFICER AT BD MORTGAGE GROUP.

Are FHA Loans Good?

FHA loans are often recommended for first-time homebuyers, buyers with less-than-perfect credit, and those who may not have a large down payment saved up. But whether an FHA loan is right for you depends on your unique financial situation and long-term goals. Below, we’ll break down the key benefits and drawbacks of FHA loans to help you decide if they’re a good option for your needs.

1. Benefits of FHA Loans

1.1. Lower Credit Score Requirements

One of the biggest advantages of FHA loans is the flexible credit score requirement.Borrowers with credit scores as low as 580 can qualify with a 3.5% down payment, while those with scores between 500 and 579 may qualify by putting down 10%.

Why This Matters: Conventional loans typically require a credit score of at least 620, making FHA loans more accessible for buyers with lower credit scores.

1.2. Low Down Payment

FHA loans allow borrowers to put down as little as 3.5%, compared to the 5% to 20% often required for conventional loans. Buyers can also use gift funds from family or friends to cover the down payment.

Example: On a $250,000 home, a 3.5% down payment would be $8,750, making it easier for first-time buyers to enter the market.

1.3. Easier Qualification

FHA loans have more lenient debt-to-income (DTI) ratio limits, with many lenders accepting a DTI of up to 56%. Employment and income verification requirements are often less stringent compared to conventional loans.

1.4. Assumable Loans

As mentioned earlier, FHA loans are assumable, meaning they can be transferred to a new buyer if the home is sold. This feature can make FHA-financed homes more appealing in the future, especially if interest rates rise.

2. Drawbacks of FHA Loans

2.1. Mortgage Insurance Premium (MIP)

All FHA loans require both an upfront mortgage insurance premium (UFMIP) and annual mortgage insurance premiums (MIP).Unlike private mortgage insurance (PMI) for conventional loans, FHA’s MIP typically lasts for the life of the loan unless the borrower refinances into a conventional loan.

Cost Example: On a $250,000 loan, the upfront MIP (1.75%) would be $4,375, and the annual MIP (0.85%) would add about $177 per month to your mortgage payment.

2.2. Primary Residence Requirement

FHA loans can only be used to purchase or refinance a primary residence. This means they aren’t an option if you’re looking to buy a vacation home or investment property.

2.3. Property Condition Standards

FHA requires homes to meet certain safety and livability standards, which can limit your options when buying a fixer-upper or older home.If the property doesn’t meet these standards, the seller may need to make repairs before closing.

3. Who Should Consider an FHA Loan?

First-Time Homebuyers:

FHA loans are often the best choice for first-time buyers because of the low down payment, easier qualification criteria, and flexible credit requirements.

Buyers with Lower Credit Scores:

If your credit score is below 620, qualifying for a conventional loan may be difficult or come with higher interest rates. An FHA loan offers a more affordable alternative.

Borrowers with Limited Savings:

FHA loans allow for a low down payment of 3.5%, and you can use gift funds or down payment assistance programs to help cover the upfront costs.

Refinancers Looking for Lower Costs:

If you currently have a conventional loan with a high interest rate and limited equity, refinancing into an FHA loan can provide a more affordable monthly payment.

4. When Might an FHA Loan Not Be the Best Option?

If You Have a High Credit Score and Large Down Payment: Borrowers with strong credit (above 720) and a 20% down payment may find that conventional loans offer lower overall costs since they don’t require lifelong mortgage insurance.

If You’re Buying a Second Home or Investment Property: Since FHA loans are only available for primary residences, you’ll need a conventional loan if you’re purchasing a second home or rental property.

If You Want to Avoid Long-Term Mortgage Insurance Costs: FHA loans require MIP for the life of the loan unless you refinance. If you want to avoid these ongoing costs, a conventional loan with PMI that can be canceled once you reach 20% equity might be a better option.

5. Summary: Are FHA Loans Good?

FHA loans are a good option for many buyers, especially first-time homebuyers, those with low credit scores, or borrowers who don’t have a large down payment. They offer easier qualification, low down payment requirements, and the potential to assume the loan in the future. However, the mandatory mortgage insurance and primary residence requirement may make them less appealing to borrowers with excellent credit or those looking to buy a second home or investment property.

Conclusion

FHA loans remain a popular and viable option for many homebuyers and refinancers in 2025, particularly those who may not meet the stricter requirements of conventional loans. With their low down payment, flexible credit criteria, and potential for assumability, FHA loans offer a pathway to homeownership for buyers who might otherwise be locked out of the market.

If you’re considering an FHA loan, it’s important to:

Understand the requirements: Ensure your credit score, down payment, and DTI ratio meet the FHA guidelines.Explore your options: Compare rates and terms from multiple FHA loan lenders and mortgage brokers to find the best deal.Plan for mortgage insurance: Be aware of the upfront and ongoing mortgage insurance costs, and consider refinancing into a conventional loan when you’ve built enough equity.

Whether you’re a first-time homebuyer with limited savings or someone looking to refinance into a more affordable loan, FHA loans can be a smart solution. However, if you have a high credit score and significant savings for a down payment, a conventional loan may be more cost-effective in the long run.

Fill out our form below to check your low down FHA loan eligibility for free.

Copyright 2025 . All rights reserved

COMPANY

CUSTOMER CARE

RESOURSES

LEGAL

© Copyright 2025. BD Mortgage Group. All Rights Reserved.