Understanding Mortgage Pre-Approval: A Guide for St. Petersburg Homebuyers

Understanding Mortgage Pre-Approval: A Guide for St. Petersburg Homebuyers

Buying a home in sunny St. Petersburg, Florida, is an exciting journey. Whether you’re a first-time homebuyer or a seasoned investor, getting mortgage pre-approval is a crucial step. It helps you understand your budget, shows sellers you're serious, and positions you to make competitive offers. This guide dives into everything you need to know about mortgage pre-approval, explained in a friendly, straightforward way.

What is Mortgage Pre-Approval?

Mortgage pre-approval is a lender’s conditional commitment to loan you a specific amount of money. Think of it as a financial green light, giving you clarity on what you can afford. During the pre-approval process, lenders review your financial details, including income, debts, and credit history.

Why is Pre-Approval Important for St. Petersburg Homebuyers?

In a competitive market like St. Petersburg, pre-approval gives you a leg up. Sellers are more likely to choose a buyer with pre-approval because it shows you’re financially prepared. Plus, pre-approval simplifies your home search by setting realistic expectations.

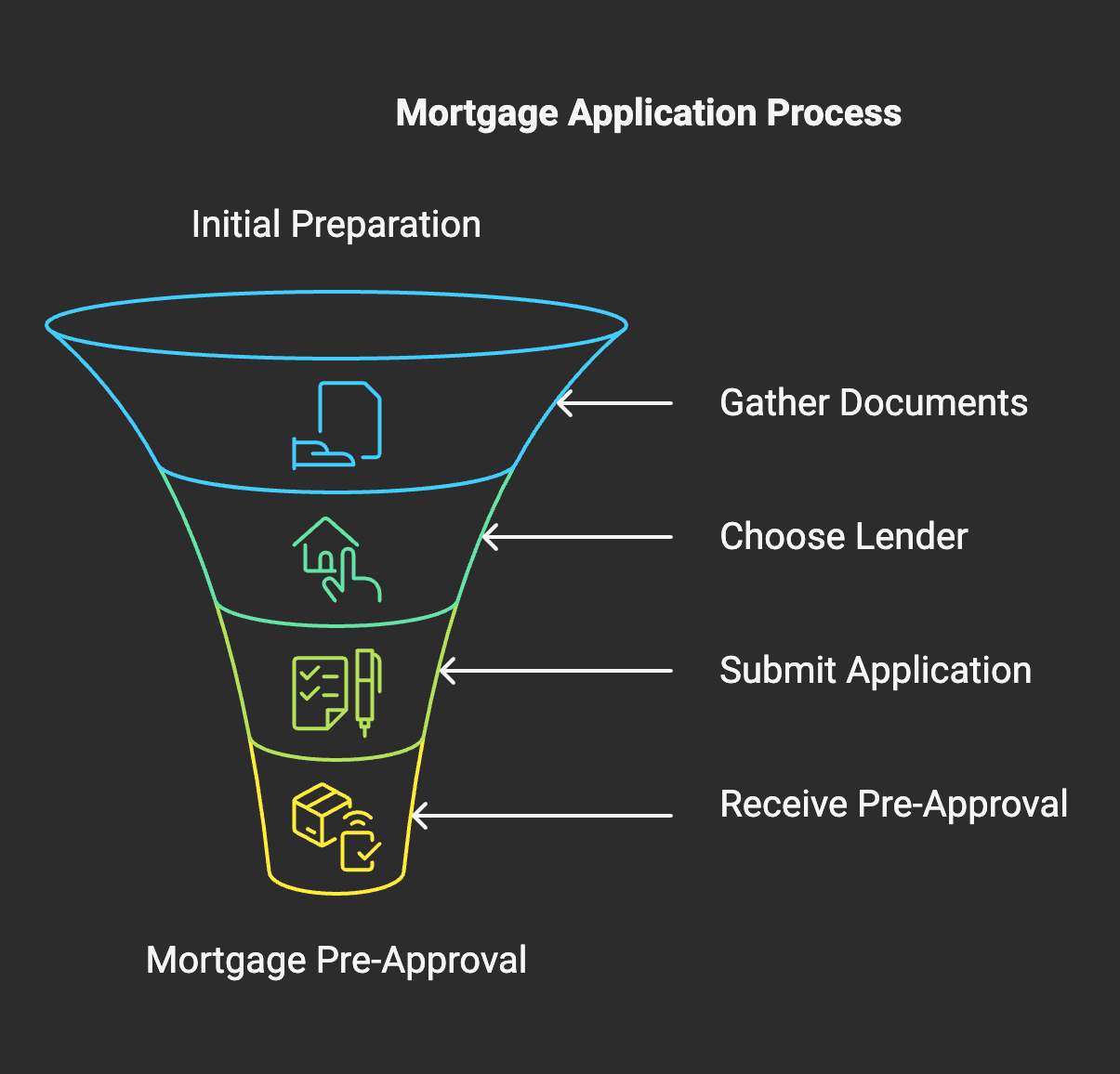

Steps to Get Pre-Approved for a Mortgage

Here’s a step-by-step guide to help you navigate the pre-approval process confidently:

1. Check Your Credit Score

Your credit score plays a significant role in mortgage approval. A higher score typically means better loan terms. Use tools like Annual Credit Report to review your score and address any errors before applying.

2. Gather Financial Documents

Lenders will ask for documentation to verify your financial situation. Commonly required documents include:

Proof of income (pay stubs, W-2s, tax returns)

Bank statements

Identification (driver’s license, Social Security number)

3. Choose the Right Lender

Not all lenders are created equal. Research local options in St. Petersburg, such as community banks or mortgage brokers, who understand the local market.

Pro Tip: Compare lenders based on interest rates, fees, and customer service. For a deeper dive, check out our blog on Choosing the Best Mortgage Lender.

4. Submit Your Application

Once you’ve chosen a lender, complete the application and submit your documents. Be prepared for follow-up questions as the lender reviews your financial profile.

5. Receive Your Pre-Approval Letter

If approved, you’ll receive a letter detailing how much you’re eligible to borrow. Keep this document handy when house hunting.

Common Myths About Mortgage Pre-Approval

Let’s debunk some myths that might be holding you back:

Myth 1: Pre-Approval and Pre-Qualification Are the Same

While both terms are often used interchangeably, they’re not the same. Pre-qualification is an initial estimate, while pre-approval involves a deeper financial review and carries more weight with sellers.

Myth 2: Pre-Approval Guarantees a Loan

Pre-approval is not a guarantee. Changes in your financial situation, like taking on new debt, can affect your final loan approval.

Myth 3: Checking Rates Hurts Your Credit

Shopping around for rates within a short period (typically 14-45 days) counts as a single inquiry, minimizing any impact on your credit score.

Pre-Approval Tips for St. Petersburg Homebuyers

Buying in a popular location like St. Petersburg comes with unique considerations. Here are tips to keep in mind:

Stay Within Your Budget

With its beautiful beaches and vibrant neighborhoods, it’s easy to get tempted by properties outside your price range. Stick to the pre-approved amount to avoid financial stress.

Factor in Additional Costs

Remember to budget for costs like property taxes, homeowners’ insurance, and HOA fees, which can vary in St. Petersburg neighborhoods.

Act Quickly

Pre-approval is typically valid for 60-90 days. Use this window to find your dream home before market conditions or interest rates change.

Internal and External Links for Your Journey

For more tips and resources:

Explore our First-Time Homebuyer Checklist.

Learn about the Benefits of Working with a Mortgage Broker.

Research local real estate trends on Zillow.

Understand interest rates with Bankrate.

FAQs About Mortgage Pre-Approval

1. How Long Does Pre-Approval Take?

The process typically takes 1-3 days if you have your documents ready.

2. Can I Get Pre-Approved with a Low Credit Score?

Yes, though your options may be more limited. Some lenders offer programs for buyers with less-than-perfect credit.

3. What Happens If My Financial Situation Changes?

Notify your lender immediately. Changes in income, debt, or credit can affect your approval status.

Key Takeaways

Mortgage pre-approval is a critical step for St. Petersburg homebuyers, offering clarity and a competitive edge.

Prepare by checking your credit, gathering documents, and researching lenders.

Be mindful of your budget and act quickly once pre-approved.

For personalized guidance, contact us at 727-761-6111 or email us at [email protected]. Visit https://mortgagebroker.guru/homebuyer-guides for more resources tailored to St. Petersburg buyers.

Ready to Get Started?

Understanding mortgage pre-approval sets you on the path to homeownership with confidence. Partner with experienced professionals who can guide you every step of the way. Reach out today—we’re here to make your St. Petersburg homebuying dreams come true!